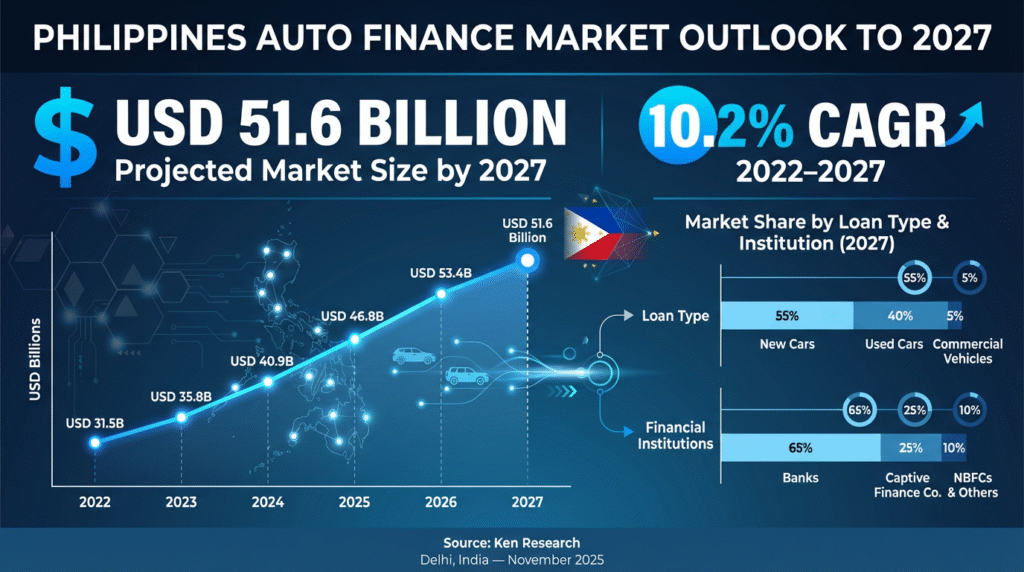

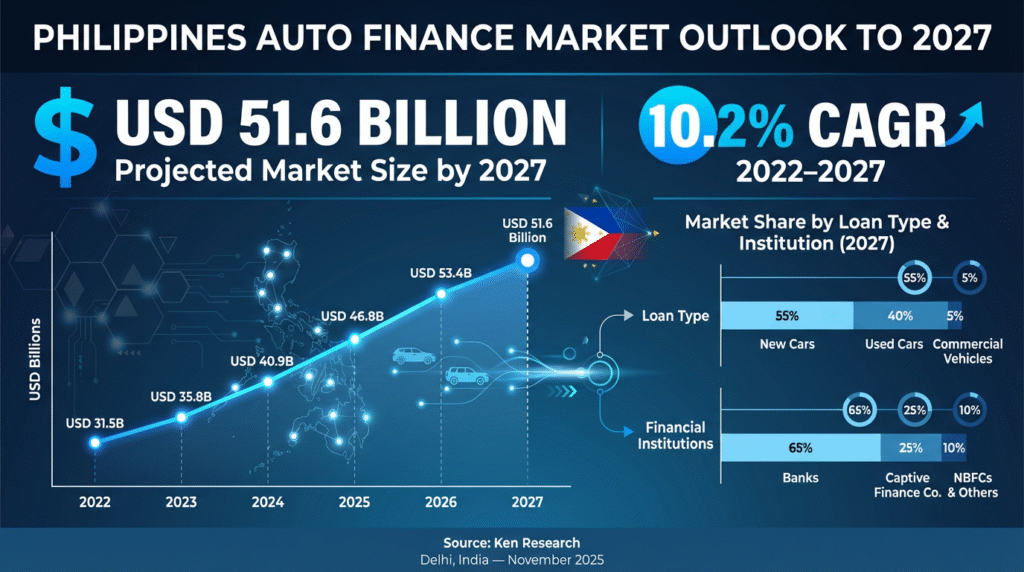

Ken Research Forecasts Philippines Auto Finance Market to Reach USD 51.6 Billion by 2027, Driven by Rising Middle-Class Vehicle Demand and Digital Lending

Delhi, India — November 2025 — Ken Research has released its latest study titled “Philippines Auto Finance Market Outlook to 2027”, projecting that the Philippines auto finance market will reach USD 51.6 billion by 2027, growing at a compound annual growth rate (CAGR) of 10.2% during 2022–2027.

The market was valued at USD 23.2 billion in 2022, reflecting the growing reliance on financing solutions to support vehicle purchases in the country. Ken Research also highlights that the Philippines auto finance market is expected to exceed PHP 1,100 billion by 2027, supported by growth in both new and used vehicle financing.

“As incomes rise and urban mobility needs intensify, auto finance has become a core enabler of vehicle ownership in the Philippines. The shift toward digital, data-driven lending is redefining how consumers access credit,” said Namit Goel, Research Director at Ken Research.

Key Market Highlights

- Market size (2022): USD 23.2 billion

- Forecast market size (2027): USD 51.6 billion

- Forecast CAGR (2022–2027): 10.2%

- Outlook in local currency: Philippines auto finance market is expected to cross PHP 1,100 billion by 2027.

According to Ken Research estimates, the market has already been expanding, supported by growing demand for used vehicles and rising financing penetration across the sector.

Key Growth Drivers

- Rising Middle-Class & Vehicle Ownership

A growing middle-income base, higher disposable incomes, and increasing aspiration for car ownership are expanding the addressable customer pool for auto loans. - Financing Penetration Across New & Used Vehicles

Financing is now central to both new and used vehicle purchases, including four-wheelers, two- and three-wheelers, buses, trucks, and LCVs. Banks remain dominant, while NBFCs and captive financiers deepen their presence in used and niche segments. - Digital Origination & Aggregator Platforms

Online loan platforms and auto finance aggregators are simplifying loan discovery and approval. These platforms collaborate with banks, captives, NBFCs, fintech lenders, and P2P platforms to deliver pre-approved, digitally processed auto loans, making access faster and more transparent. - Supportive Policy & Financial Inclusion Focus

Government efforts toward financial inclusion and digital finance are indirectly supporting auto loan growth by improving access to formal credit for a broader population segment.

Market Structure & Competitive Landscape

The Philippines auto finance market is moderately fragmented. Major banks such as BDO, PNB, RCBC, Maybank and Metrobank are positioned as leaders due to their large customer base, strong demand for auto loans, and higher digital penetration.

Non-bank financial companies (NBFCs), captive finance subsidiaries and emerging fintech players are increasingly focusing on used vehicles, flexible repayment plans, and digital experiences, creating a more competitive and customer-centric financing environment.

Strategic Opportunities Highlighted in the Report

The Ken Research report identifies several opportunity areas:

- Used vehicle finance: Strong upside in financing pre-owned cars and motorcycles as affordability remains a key factor for many borrowers.

- Two-wheeler and small commercial vehicle finance: Rising demand from gig workers, delivery services, and SMEs supports growth in these categories.

- Digital and AI-based credit models: Use of digital onboarding, AI/ML credit scoring and instant approvals is reshaping risk assessment and customer experience.

- Flexible payment and EV-linked offers: Flexible payment plans and promotional schemes for electric vehicles are emerging as differentiators among lenders. “The transition from purely branch-based, paperwork-heavy processes toward digital-first journeys is no longer optional. Players that integrate dealers, aggregators, and analytics into a unified auto finance stack will be best positioned to capture growth through 2027,” added Harsh Saxena, Principal at Ken Research.

Report Highlights: “Philippines Auto Finance Market Outlook to 2027”

The report delivers:

- Market size by loan disbursed, loan outstanding, and number of vehicles financed (2017–2027)

- Segmentation by type of lender (banks, NBFCs, captives), vehicle type (2W, 3W, 4W, buses, trucks), new vs used, and loan tenure brackets

- Competitive benchmarking of leading banks, NBFCs, captives, and online aggregators

- Customer journey mapping, vendor selection criteria and regional financing penetration

- Forecasts for loan disbursed and loan outstanding up to 2027, with scenario analysis and analyst recommendations

Contact:

Ankur Gupta

ankur.gupta@kenresearch.com

+91 9015378249

About Ken Research:

Ken Research provides data-backed market intelligence across financial services, automotive, consumer lending and other high-growth sectors. Its research frameworks and primary-data–driven analysis help lenders, investors and businesses make informed, strategic decisions in evolving markets.